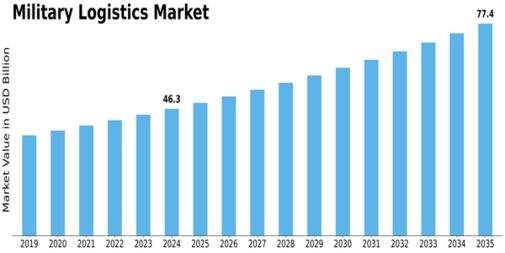

The global security environment is shifting rapidly — from great-power competition to hybrid warfare and humanitarian crises. In this context, the global Military Logistics Market is emerging as a critical investment area for defence forces and logistics providers alike. According to (MRFR), the market was valued at USD 43.1 billion in 2022, is estimated at USD 45.255 billion in 2023, and is expected to reach USD 60.64 billion by 2030, growing at a CAGR of 5.00 %.

Opportunity Landscape

-

New military bases & deployments: As nations expand their forward presence and strategic logistics footprint, demand for transport, warehousing, base services and supply-chain management rises.

-

Technological upgrade cycles: Logistics is undergoing transformation — adoption of unmanned logistics vehicles, digital tracking, predictive maintenance and networked supply chains all contribute to new service demand. MRFR cites GIS, RFID and unmanned logistics as growth levers.

-

Expanded mission sets: Armed forces are increasingly involved in humanitarian assistance, disaster response and peace-keeping operations, all of which require robust logistics.

-

Emergence of resilient supply chains: In contested, remote or denied environments, logistics resilience is paramount. This pushes demand for flexible transport modes, warehousing solutions and digital visibility.

Key Market Data

-

2022 market size: USD 43.1 billion.

-

2023 estimate: USD 45.255 billion.

-

2030 forecast: USD 60.64 billion.

-

Forecast CAGR (2023-2030): 5.00 %.

-

Dominant transport mode: Roadways.

What’s Holding It Back?

-

High capital and operating costs: Military logistics demands ruggedised infrastructure, secure transport, global reach and often harsh environmental conditions.

-

Supply-chain complexities: From multiple modes (road, air, sea) to coordination across theatres and ally networks — logistics is inherently complex in defence.

-

Requirement for technology integration: To gain advantage, defence logistics must integrate digital platforms, analytics and automation — this transition takes time and investment.

-

Regulatory and geopolitical risk: Defence logistics may involve sensitive cargo, cross-border transport, export controls and contested environments — all adding risk and cost.

Strategic Takeaways

-

For logistics providers: Focus on end-to-end capabilities, especially digital supply-chain visibility, multi-modal transport, responsive warehousing, and maintenance/repair services.

-

For defence stakeholders: View logistics not just as support but as a strategic enabler—optimised logistics can equal faster deployment, greater reach, and higher operational readiness.

-

For investors: Companies that deliver advanced logistics solutions, especially with technology differentiation (autonomous delivery, IoT tracking, analytics) may capture premium growth.

Conclusion

The global Defense Logistic Market is on a steady growth path. With MRFR forecasting an increase from USD 43.1 billion in 2022 to USD 60.64 billion by 2030 at a 5 % CAGR, the sector offers compelling opportunity for service providers, defence agencies and technology firms alike. The key will be embracing innovation, solving logistics complexity and managing cost and risk effectively. In doing so, stakeholders can position themselves to capture value in the evolving defence-logistics ecosystem.